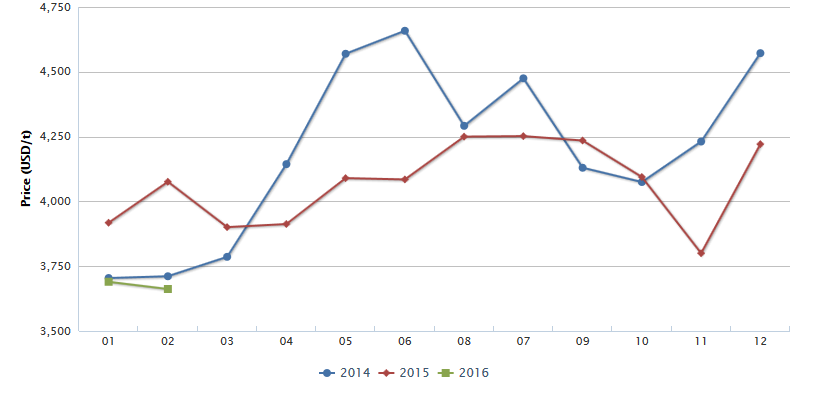

In Q1 2016, the market price of vitamin C (VC) in China remained low and

stable. In Feb., the domestic market price of 99% feed grade VC powder was

USD3,662 /t (RMB24,000 t/a), similar to that in Jan., according to CCM’s price

monitoring. In early March, the quotation for VC from major domestic producers,

such as CSPC Pharmaceutical Group Co., Ltd. (CSPC Pharmaceutical), Northeast

Pharmaceutical Co., Ltd. (Northeast Pharmaceutical), and Shandong Tianli

Pharmaceutical Co., Ltd. (Tianli Pharmaceutical), was between USD3,360/t

(RMB22,000/t)-USD3,520/t (RMB23,000/t).

Market price of 99% feed grade vitamin C powder in China, Jan. 2014-Feb. 2016

Source: CCM

Currently the price of VC has stopped decreasing, because the stricter

environmental protection policy has influenced the operating rate. However, the

price is unlikely to increase, because of the excess capacity.

Domestic production:

Because of the depressed market price of VC, North China Pharmaceutical Co.,

Ltd. (North China Pharmaceutical), a major VC manufacturer in China, suspended

the production of VC. Besides, the company is relocating its VC factory,

because of the constraint from local environmental protection policy.

It may

not resume production within this year. Even so, the excess capacity of VC in

China can’t be reduced effectively. It is noted that Shandong Luwei

Pharmaceutical Co., Ltd. (Luwei Pharmaceutical) and Tianli Pharmaceutical are

rapidly expanding the production of VC.

In 2015, the total domestic capacity of VC was estimated to be above 180,000

t/a and the output slightly increased to around 153,000 tonnes, of which only

30,000 tonnes were consumed in China. Actually, CSPC Pharmaceutical, Luwei

Pharmaceutical, and Tianli Pharmaceutical accounted for more than 60% of the

domestic VC market share.

Export:

In 2015, China’s export volume of VC decreased by 1.42% YoY to 123,710.522

tonnes, with its export value fell by 5.88% YoY to USD434,220,913. Obviously,

the export price has witnessed a decline, which increased the pressure on

domestic VC producers who are already on the brink of loss.

In Jan., 2016, China’s export volume and export value of VC both fell MoM,

resulting from the weak demand from overseas market.

China's exports of vitamin C, Jan. 2014-Jan. 2016

Source: China Customs

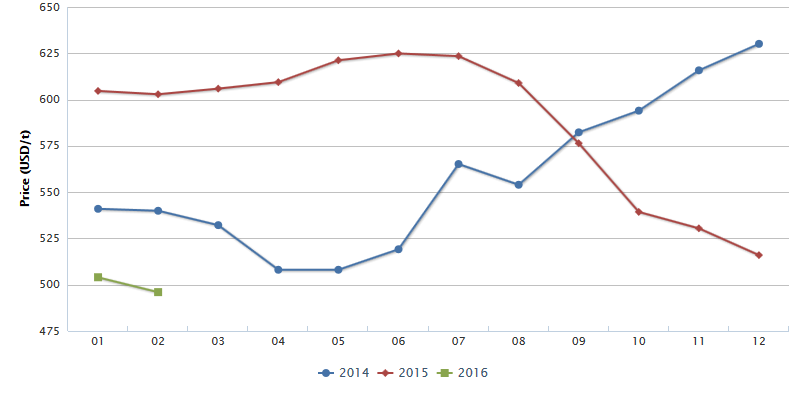

Raw material:

In 2015, the rising price of raw materials has further squeezed the

profitability of VC. In China, VC is mainly produced by two-step fermentation

method, which with sorbitol as starting material.

Last year, the average domestic market price of 70% sorbitol was USD589/t

(RMB3,759/t), a YoY increase of 5.6%, according to CCM’s price

monitoring.

However, since H2 2015, domestic VC producers have reversed the poor situation

of poor profitability, because of the continuous decline in prices of corn and

sorbitol.

Ex-works price of 70% syrup sorbitol in China, Jan. 2014-Feb. 2016

Source: CCM

Forecast:

In the short term, given the overcapacity and production expansion in domestic

VC industry, it is unlikely for the price of VC to increase substantially.

In the long run, as the competition between producers become more intense, it

may cause a decline in the price of VC. This may force some producers, who are

on the brink of loss, to stop the production of VC.

Besides, under the pressure of stricter environmental protection policy, some

VC enterprises may greatly reduce their production or even withdraw from the VC

market. By then, the domestic VC industry will get rid of overcapacity and

embrace a significant rise in the price of VC products.

This article comes from Corn Products China News 1603, CCM

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us directly by emailing

econtact@cnchemicals.com or calling +86-20-37616606.

Tag: vitamin VC